EQUITY-BOND CORRELATIONS: WAS 2022 REALLY AN ANOMALY?

SHOULD WE BE SURPRISED ?

The simultaneous decline in both equities and bonds in 2022 cast fresh doubt on the widely held belief that these asset classes typically move in opposite directions. Just how rare are these so-called “exceptional” years, and what can investors with long exposure to both markets do to strengthen their portfolios against such events?

KEY TAKEAWAYS

· We challenge two prevailing assumptions: first, that bonds and equities tend to be reliably negatively correlated; second, that long-only portfolios diversified across both are inherently resilient.

· While negative daily correlations between stocks and bonds are common, their yearly performances have moved in the same direction in over two-thirds of the years since the 1980s.

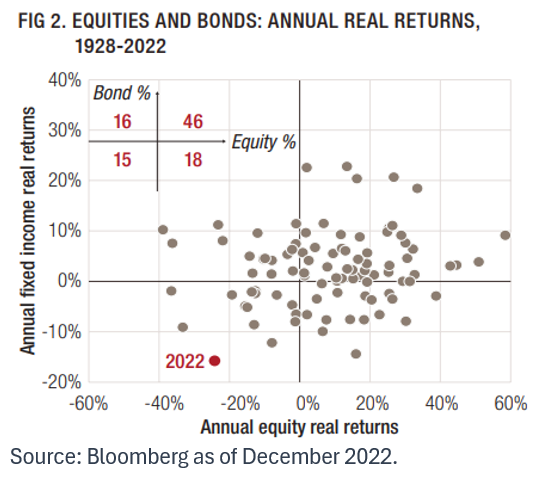

· Looking at inflation-adjusted returns, both equities and bonds posted negative results in 15 out of 95 years since 1928—including 2022. Investors must be better equipped for the not-so-unlikely scenario of simultaneous declines in both asset classes.

WAS 2022 TRULY UNIQUE?

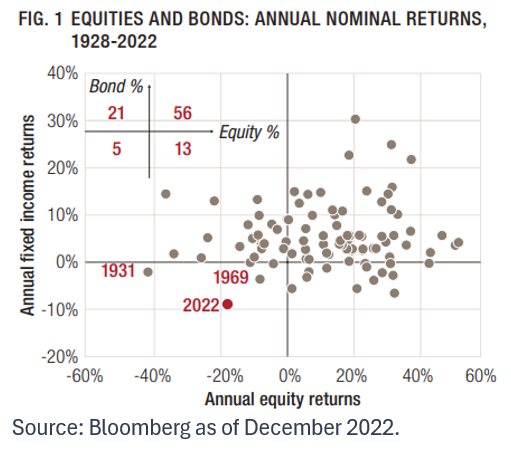

Passive investors faced considerable headwinds in 2022, with both stock and bond markets ending the year in the red. This scenario is frequently described as atypical. As shown in Figure 1, the year is often cited as exceptional for two primary reasons:

1. The correlation between equity and bond returns turned positive—contrary to the conventional expectation of negative correlation.

2. Portfolios with broad beta exposure across equities and bonds are believed to rarely suffer simultaneous losses, with diversification seen as a core risk mitigator.

RETHINKING TRADITIONAL ASSUMPTIONS

Let’s begin with the idea that equities and fixed income generally move in opposite directions. This belief underpins many portfolio construction models—especially the traditional 60/40 mix that relies on bond-equity diversification for stability.

Though daily returns do often display negative correlation, a look at annual data (see Figure 1) tells a different story. Given that most investors plan with a horizon of months or years—not days—we argue that annual correlations are far more relevant for asset allocation decisions. This underscores the importance of considering correlations across different time frequencies.

Since the early 1980s, more than 66% of years have seen equities and bonds trend together—either both positive or both negative. Curiously, investors raise few concerns when both markets rally simultaneously.

HOW RARE WAS IT, REALLY?

At first glance, 2022 appears to be an infrequent exception. Among 95 years of market data, only five—including 2022—have seen both asset classes fall simultaneously in nominal terms. However, when adjusting for inflation, we find that equities and bonds have both posted negative real returns in 15 years. That equates to roughly a 16% chance of such a scenario in any given year—far from a black swan.

(See Figure 2 for details on real-return years.)

DIVERSIFICATION: NOT SO STRAIGHTFORWARD

We don’t deny that 2022 was a tough year for beta investors—and even worse when viewed through an inflation-adjusted lens. That said, we contend the following:

1. Relying on a stable negative relationship between equities and bonds is misguided.

2. Years where both equities and bonds deliver negative real returns may be infrequent, but they are not rare enough to be ignored as outliers.

With this perspective, we reaffirm our commitment to strategies that pursue genuine diversification. Investors may benefit from complementing traditional allocations with niche, low-correlation approaches. These include hedge fund strategies such as macro, quantitative, relative value, and multi-strategy—each of which can offer portfolio protection through alpha generation without reliance on directional market exposure.

With that in mind, we reiterate our conviction in investment solutions that provide genuine diversification. We believe that niche strategies which can deliver alpha with almost zero correlation to the market play an important role in an asset allocator’s risk-management and portfolio-construction strategies. They include hedge-fund strategies exhibiting no directional bias, such as multi-strategy, quantitative, macro and relative-value solutions

March 2023

Updated as of June 2025